CropConex Trials New De-Risked Payments, A First For Ethiopia

CropConex is a global e-commerce company with a mission to power agricultural supply chains that are efficient, profitable, and traceable. The platform connects previously siloed farmers, buyers, and logistics providers on an integrated supply chain management and electronic trading platform. In a sector dominated by fragmented supply chains and weak market linkages, CropConex offers an end-to-end solution that digitizes operations across the entire ecosystem.

As part of our solution, we integrate payment systems to facilitate transactions between our customers (buyers and sellers) accounts within and between the commercial banks in Ethiopia. CropConex is trialing a technology systems integration with commercial banks to pilot a new “escrow payments” solution for the Ethiopian coffee sector.

Escrow is a financial process used when two parties take part in a transaction and there is uncertainty about the fulfillment of their obligations. CropConex seeks to offer innovative risk mitigation strategies for buyers and sellers through these escrow payments facilitated through the platform.

Consider a supplier that is selling coffee to a buyer locally. The supplier requires assurance that it will receive payment when the coffee reaches the destination. The buyer is responsible to pay for the coffee when it arrives in the contracted condition (grade and weight). This way, both parties are protected and the transaction can proceed.

On CropConex, coffees can be listed in the marketplace by suppliers and buyers can order samples and contract sales agreements. When a contract is entered on the platform we send the details information through our API to the bank to initiate the payments process. The funds are debited from the buyers bank account and moved to a special escrow account where it is held for up to 3 days. During this time, the coffee is dispatched from the region to be delivered to the buyer in Addis. The buyer cannot withdraw the funds from the escrow account once the coffee is in transit. Once the coffee arrives and is approved on the platform the funds are released and transferred to the seller.

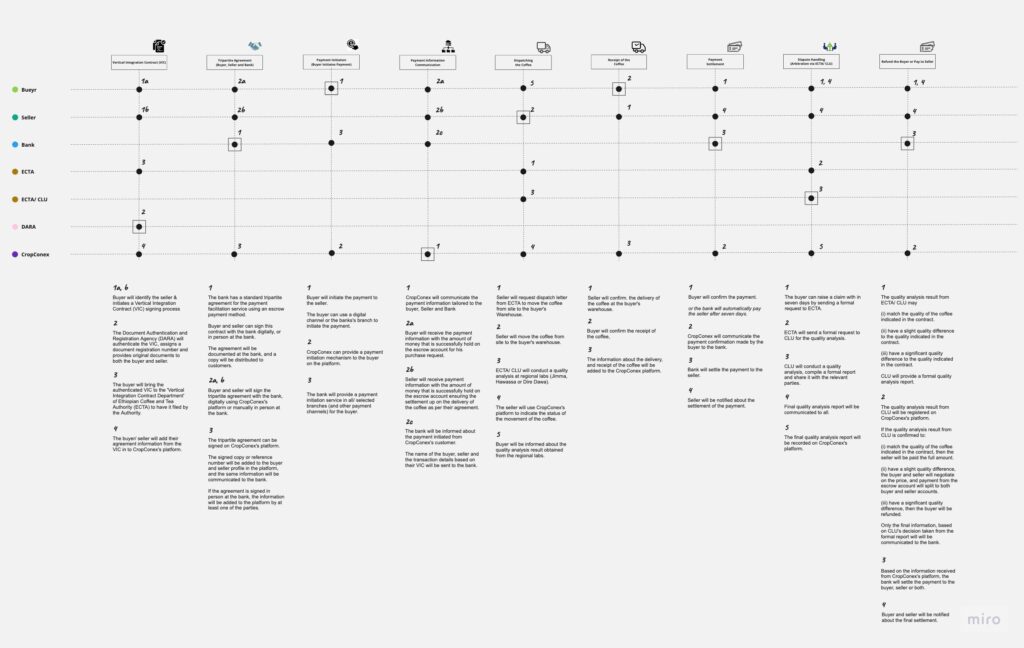

Explore the escrow process in depth through our infographic below.